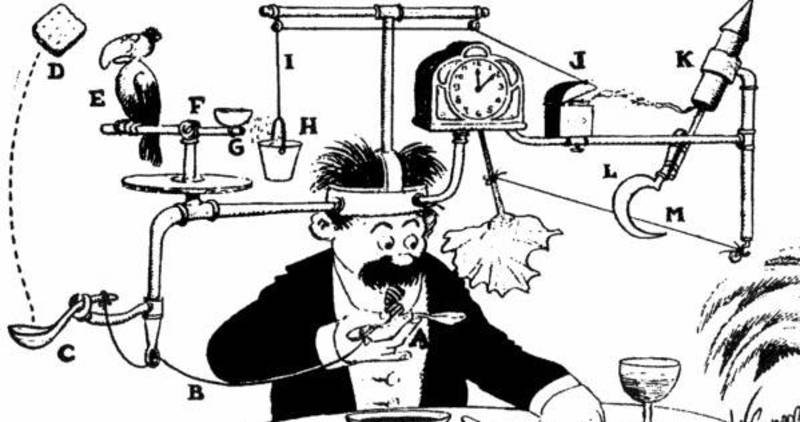

We live in an immediate gratification world. The internet isn’t fast enough. Cars push the horsepower envelope.

In contrast, life insurance companies take carefully managed risk in exchange for a premium.

The process of assessing that risk flies in the face of the lust for immediate results.

Recently, virtual agencies have become more prolific with some featuring online automated “underwriting”.

With the emergence of advances in Artificial Intelligence (AI), the “need for speed” might lead you to believe that these applications produce ready made results.

Search and you will find the fine print. Still these underwriting engines are not totally without merit

We are going to relate the benefits as well as the pitfalls of these processes.

With online underwriting several common underwriting questions are posed to the shopper. As with all life insurance these are health, family history and lifestyle related.

Let’s shed some light on the both the nature of this automation and it’s relevance to getting approved at the best rate.

Start with our “Health Ratings” post and be honest with yourself about your health and lifestyle. Then, chances are when your go to our term life rate comparison engine and compare 10 or more companies your rate will be very accurate.(height and weight), age and tobacco use, it’s easy to be accurate. From there these trails can easily leave you lost as you get into the details of your medical history .

The reason these “quiz” formats fail is that many of the automated medical questions tend to be catchall and not close to the level of detail contained in an application.

Certain particular common questions in these quiz formats related to hypertension (high blood pressure), diabetes and high cholesterol can only scratch the surface of the extent and the measures taken to manage these health conditions.

True underwriting is much more detailed including duration of the condition, medications and doctor info.

It’s fair to say the the questions in these applications are not unusual and do leave the shopper with some self awareness.

The benefit ends of course when plans and companies presented do not represent a true and complete cross section of choice.

The process serves a beneficial purpose in disqualifying those who would have certain conditions from getting term life insurance.

Unlike final expense, there is a very limited choice for guaranteed issue term life outside of employer sponsored coverage.

Summing up, this is really just a screening as any fully underwritten application must also include a paramed or medical exam. The paramed validates all of your health conditions including build (height and weight), vital signs and any abnormalities uncovered in a blood test.

Being a “need based” solution, rarely do we get someone who is excited about the application process. There are many other things to do that are more enjoyable and interesting – we get it.

What we have found as a result is a natural tendency towards immediate gratification, even if it does not best serve your financial interests. With shopping online ever more the norm it easy to be led or in some cases misled.

Without getting a clear picture of one’s health, lifestyle and family history there is no easy way in most cases to provide anything other than a best guess.

Everyone wants the life insurance plan that will provide with the highest level of benefit at the lowest rate. Right?

We have also seen in these online “screening applications” from an online search or pushed to social media can produce a wide range of results.

The recommendations are delivered online at a click, we find a sort of herding by way of stating “This is who we recommend” or something similar and then entice you to “complete the application”.

It’s not at all like Ebay or Amazon that will suggest alternatives based on your search.

Moreover you are merely continuing the shopping process as no legitimate application is taken online unassisted.

Be careful with just giving out phones and emails as many sites are nothing more than lead generators that sell your info many times over and create a significant disruption in your life.

Other than the really healthy and especially those who have complex health issues pinpointing a health rating and the monthly rate is beyond the capacity of today’s technology.

We know to place the application with the company who may favor or at least be lenient to certain health conditions. None of these capabilities are available in online health questionnaires.

A critical bit of analysis that is also overlooked by these quiz formats is true needs determination that matches with budget and long term view.

Most “needs analysis” questioning is designed to create the upper limits of coverage and does not take into consideration timing of expected events (family additions, duration of the insured asset like a house) and other financial resources in addition to budget.

Adding it up this one and done approach to shopping for life insurance is in our opinion a fool’s errand. There may be underlying need that has not been considered, certain options like conversion rights that are not evaluated and the like.

Meanwhile by submittal you may be very likely committed to the phone calls and emails that in our experience has caused some to change phone numbers.

At the “Mall” we ascribe to Shop then Choose as the first part of the process. Take careful inventory of your true need matched to the budget and be aware of certain future events and their timings.

Your information and privacy is respected and never, ever sold. Our quoting tools are free to use, produce results from 10 or more companies on demand, and you may reset and requote without limits for term, benefit and health rating.

Should you “Choose” please understand that this would be only the start of an application and you are never obligated.

Only a life insurance company can approve and issue the policy. What we do is advocate for you at no cost to deliver a diversity of options and provide the expertise through the application process to achieve the optimal outcome.

Perhaps AI will develop to the extent that true automation will be available and we consult with certain groups working to that end. Until that time, be sure to follow the best path to success that you may avail yourself to now.

Shop. Choose. Focus. Apply. You can start with the quoting tool with no cost or obligation and there is never a fee to enroll.